Understanding the BOIR Filing

What is a BOIR Filing?

A “BOIR” stands for Beneficial Ownership Information Report. The Beneficial Ownership Information (BOI) Report is a new requirement under the federal Corporate Transparency Act (CTA). The CTA was enacted in 2021 to combat financial crimes like money laundering and financing terrorism. Its aim is to prevent individuals from hiding ownership of U.S. entities to facilitate illegal activities. A BOI Report lists a company’s “beneficial owners”—the individuals who actually own or control the business. This report is filed online with the US Treasury Department’s Financial Crimes Enforcement Network ( FinCEN).

Who is Required to Submit a BOIR Filing?

The Beneficial Ownership Information Reporting rule requires all non-exempt businesses—including legitimate small businesses—to file a report providing information about the people who own and control the company. And there are steep penalties for willful non-compliance or willfully failing to file accurately. Here is the complete list of business types that are exempt from filing.

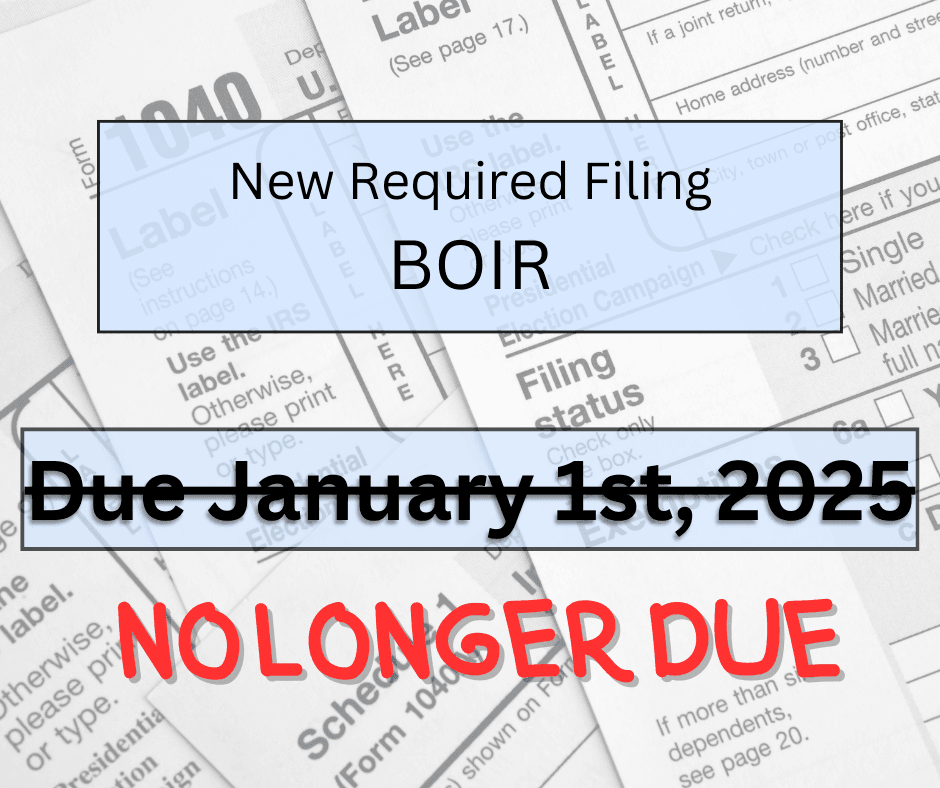

When is the BOIR Filing Due?

FLASH UPDATE: January 1, 2025 deadline is suspended until further notice.

Consequences of Non-Compliance

There are steep penalties for willful non-compliance or willfully failing to file accurately. Civil penalties can be up to $591/ day. Criminal penalties can include thousands of dollars in fines, as well as imprisonment.

BOIR Requirements

The BOIR form requires detailed information about the business’s beneficial owners. This includes:

- Full legal name

- Date of birth

- Permanent Address

- Driver’s License number or Passport number

- Image of identifying document

The BOIR form also requires information about the business. This includes:

- Identifying Number (EIN)

- Legal Name, per organizing documents

Conclusion

The BOIR form is a critical requirement for many businesses. By understanding the filing obligations and potential consequences, businesses can ensure compliance with the Corporate Transparency Act and avoid penalties.

When I know more, we will update you accordingly.

Disclaimer: This information is intended to provide a general overview and should not be construed as legal advice. It is recommended to consult with a tax professional (Like me!) or legal advisor for specific guidance related to your circumstances.